Graphene looks set to disrupt the electric vehicle (EV) battery market by the mid-2030s, according to a new artificial intelligence (AI) analysis platform that predicts technological breakthroughs based on global patent data.

With the global transition towards an electrified transportation system gathering pace, the search for the perfect EV battery – offering the ideal balance of cost, energy density, safety and environmental sustainability – becomes ever more salient. There are around a dozen battery chemistries vying for market dominion; which one will emerge victorious is the veritable trillion-dollar question. For the near-term at least, traditional lithium-based batteries are likely to maintain their grip on the market, with sodium-based batteries offering a cheap and green alternative for certain applications, according to new research from Focus, an AI analysis platform that predicts technological breakthroughs based on global patent data. It is the emergent graphene and dual-ion batteries, however, that are likely to truly disrupt the market one day.

The research suggests that graphene batteries in particular will emerge in the early to mid-2030s to challenge their lithium counterparts for the EV crown, as the price of graphene production falls precipitously. This development promises to not only vastly improve EV performance but also offer a boon to energy efficiency and carbon reduction targets. “If there is one battery technology to keep an eye on, it is graphene,” says Jard van Ingen, Focus’s CEO and co-founder.

The young pretenders

Focus analyses the current state of EV battery chemistries and forecasts which ones look set to dominate in the years ahead. Using an approach inspired by research from the Massachusetts Institute of Technology, the Focus platform processes large volumes of global patent data in real time using three types of AI: large language models do continuous research into global patent data archives for tech scouting, scoring and comparisons; vector search provides real-time intelligence on the global innovation and technology landscape; and multivariate regression offers predictive analytics by identifying relationships between data and real-world outcomes. Focus calculates ‘Technology Readiness Levels’ for the maturity of battery technologies and a ‘Technology Improvement Rate’ to measure the increase in performance per dollar per year of different battery chemistries.

“In essence, for EVs, it is all about finding that sweet spot between energy density, safety, cost and sustainability,” says Kacper Gorski, Focus’ head of operations. “Each of these chemistries brings something unique to the table, and their development will shape the future of electric mobility. The key question is, however, which are actually progressing fast and which are over-hyped?”

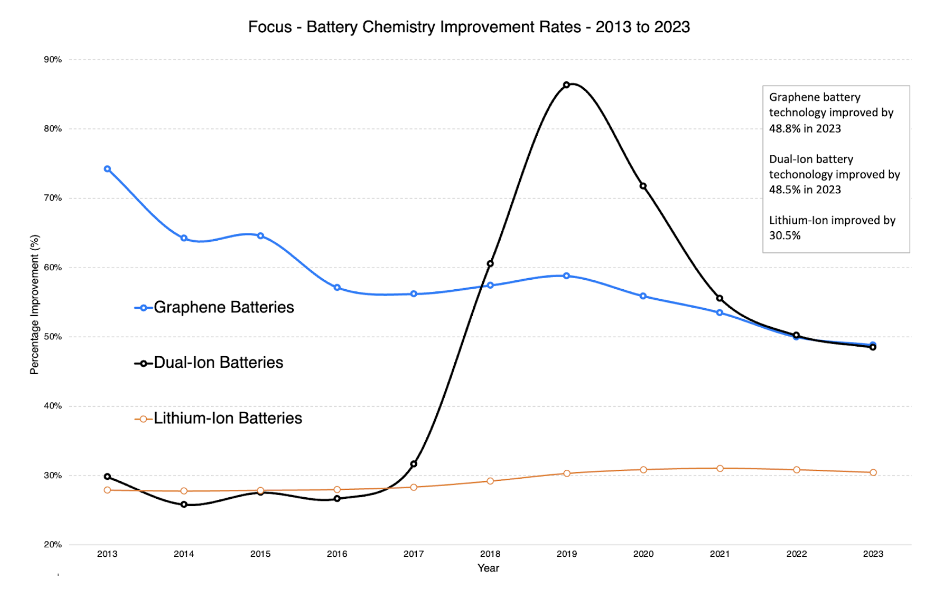

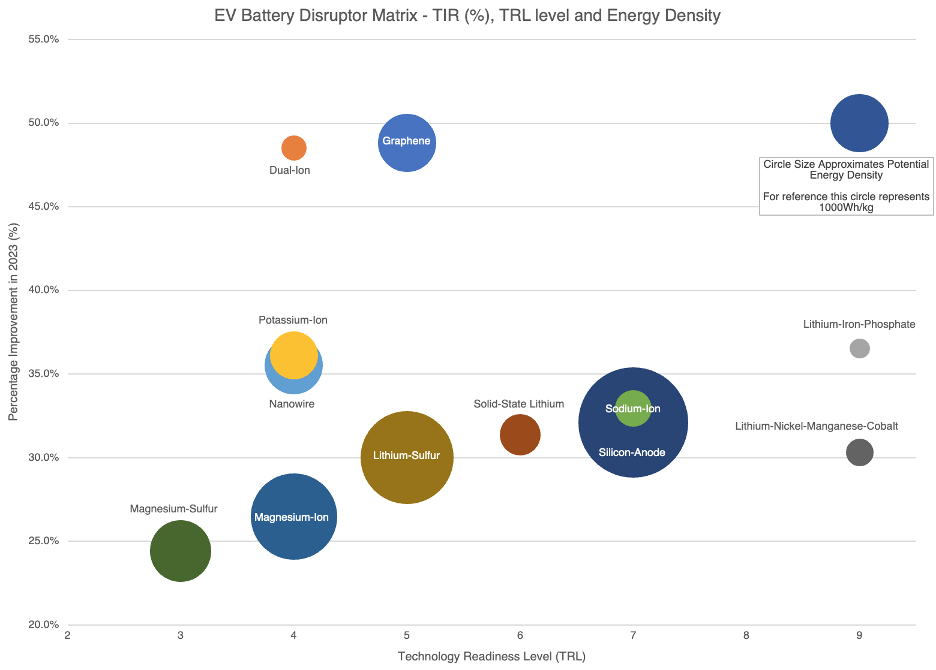

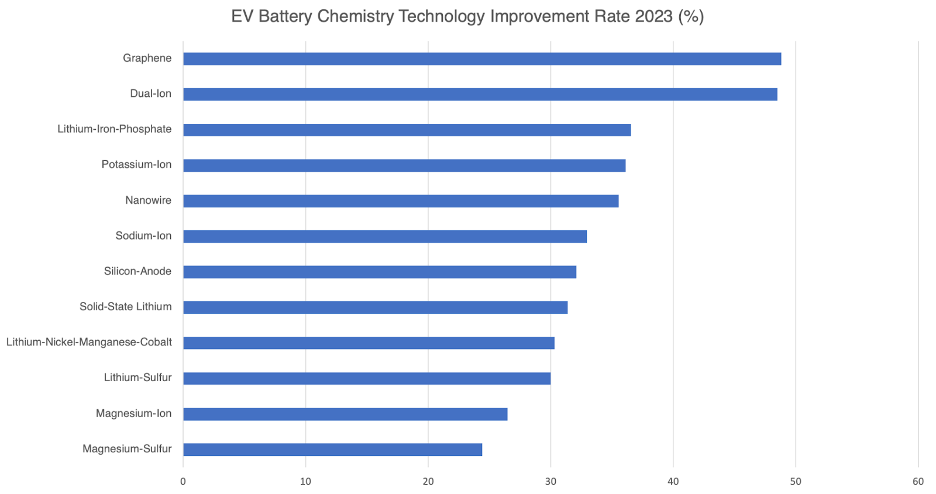

Focus found that all lithium-based battery technologies are improving at similar speeds. The current dominant chemistries, lithium-nickel-manganese-cobalt and lithium-iron-phosphate, are improving year-on-year (YoY) at rates of 30% and 36%, respectively. Lithium sulphur batteries are improving at 30% YoY and silicon anodes at 32%, meaning the pair are unlikely to disrupt the market – truly disruptive technologies have improvement speeds that are significantly and consistently higher than their competitors. Similarly, although much has been written about the potential of solid-state lithium batteries, Focus found the technology is only improving at a rate of 31% YoY, meaning it too is unlikely to disrupt the incumbents.

The same goes for similarly hyped sodium batteries, which have a 33% improvement rate – putting them within a measurement error of lithium-iron-phosphate batteries. Van Ingen explains that sodium batteries have a relatively modest energy density, limiting the mileage they can offer EVs without adding too much weight to the vehicle. They would, however, make sense for stationary storage, where weight is not a limiting factor. “So if all you need is relatively cheap batteries for grid demands, then sodium-batteries make a lot of sense,” he says. “They could even work for lower-end EVs – really cheap, high volume–production vehicles designed for short distances. It is a relatively fast improving technology, it is just not going to completely disrupt the market.”

It is some of the more nascent battery chemistries that are generating the most excitement. Magnesium-sulphur batteries are improving at a rate of 24.4% YoY, magnesium-ion batteries at 26%, nanowire batteries at 35% and potassium-ion batteries at 36%. However, these all pale in comparison to graphene batteries, which are improving at a whopping 48.8% YoY, or dual-ion batteries, which boast a 48.5% YoY improvement rate. “Because the improvement speeds of graphene and dual-ion batteries are significantly and consistently higher than other battery chemistries’, these can be considered disruptive,” says van Ingen.

However, in a head-to-head between the two chemistries, Focus believes graphene batteries hold the higher potential, as the research is more developed and the element more ubiquitous. The technology offers a huge step up for the performance of EVs, promising high energy densities, increased cycle life (the number of charge and discharge cycles a battery can complete before losing performance) and fast charging. Its main downside at present is its prohibitive cost, driven by the eye-wateringly expensive price tag of graphene production.

“Graphene is a really basic material derived from any carbon source,” says van Ingen. “The base material is really plentiful, it is all over the place, but the way to turn it into graphene is the limitation. Current production methods are way too expensive.”

Graphene batteries, the true disruptor

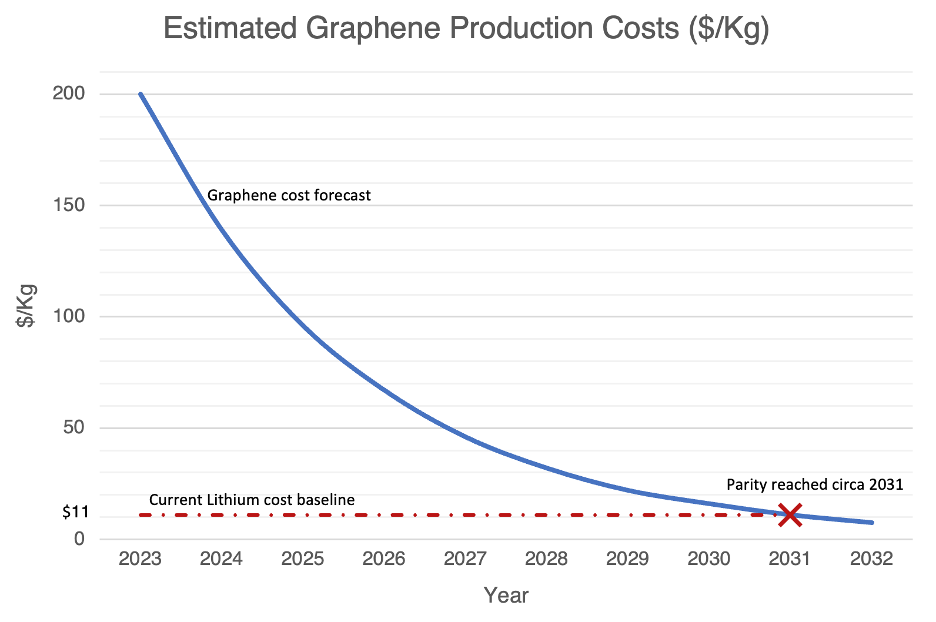

For graphene batteries to disrupt the EV market, the cost of graphene production must come down significantly. Graphene is currently produced at around $200,000 per ton, or $200 per kilogram (kg). It is difficult to predict how cheap production needs to be before manufacturers start to use it in their batteries, but Focus believes this will happen when graphene becomes comparable with lithium.

Lithium carbonate currently costs around $16/kg to produce and analysts believe it could fall a further 30% to $11/kg in 2024. Focus’s forecasting method estimates the improvement speed of graphene production at 36.5% YoY. So, assuming the current price of $200/kg and a target price of $11/kg, Focus forecasts graphene production will become cheap enough for the material to force its way into battery chemistries by around 2031.

According to Focus, there are around 300 organisations currently working on graphene battery technology. Of the top ten companies best positioned to disrupt the battery market with graphene, Focus ranks Global Graphene Group as the leader. Its subsidiary, Honeycomb Battery Company, recently announced a landmark combination deal with Nubia Brand International aimed at enhancing Honeycomb’s manufacturing and research capabilities, with a primary focus on advanced battery technology for EVs.

Similarly, StoreDot, the only start-up in the top ten, has made impressive progress in 2023. The company is set for mass production of its ‘100in5’ battery cells in 2024. These cells are designed to deliver at least 100 miles of range with just five minutes of charging. StoreDot has formed strategic agreements with the likes of Volvo Cars (Geely), VinFast and Flex|N|Gate. In early 2024, it collaborated with Volvo Cars’ Polestar on the world’s first ten-minute EV charging demo. Its battery quality has been validated after testing by 15 leading global manufacturers, showing no degradation even after 1,000 consecutive ‘extreme fast charging’ cycles.

Toray Industries, on the other hand, has been identified by Focus as the fastest iterating player (the lowest cycle time). The company has made significant progress in its graphene battery research, developing an ultra-thin graphene dispersion solution with excellent fluidity and electrical and thermal conductivity – particularly beneficial for applications such as battery and wiring materials. Toray is thus able to create very thin, high-quality graphene from inexpensive graphite materials. The technology, claims Toray, offers a 50% better battery life than traditional carbon nanotubes used as conductive agents.

“Looking ahead, the biggest bottleneck now for graphene batteries is to find a production method that can really do it at scale,” concludes van Ingen. It is still a field mostly dominated by research, but this will catapult it out into the real world within the next decade, according to Focus.

Source: Energy Monitor